The Child Care Subsidy (CCS) helps eligible families access approved and registered child care, by subsidising some of the cost. This subsidy could be as high as 85% of the cost of child care.

The CCS is calculated by a number of factors including: activity level, combined family income, service type and hourly rates. See below further information on these factors. Visit the Department of Human Services website for further information or to confirm your child’s enrolment details for the CCS.

-

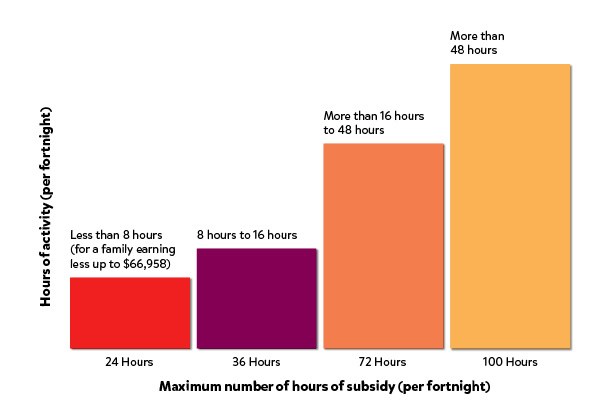

Activity Level

The amount of recognised activities completed in a fortnight such as paid work, study, volunteering.

Graph 1: Hours of Activity

-

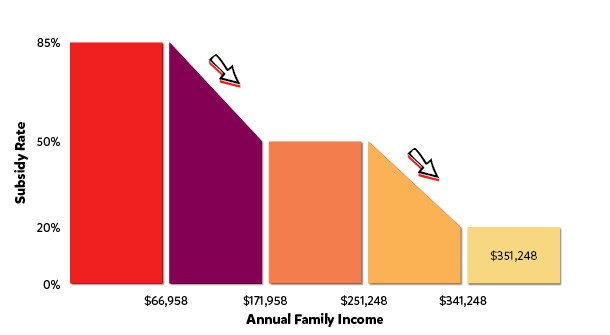

Combined Family Income

The family income estimate determines the amount of subsidy which will offered to you.

Graph 2: Combined Family Income

-

Service Type and Hourly Rates

The amount of Child Care Subsidy you can receive depends on the type of service you use, the hourly rates and age of your child. Visit the Department of Human Services website for further information. See below a summary of hourly rates for our services.

School Holiday Program Session length: 10 hours (8:00am -6:00pm)

Daily rate: $74.00

Hourly rate: $7.40

*Bookings can only be made for a full day session. Half days are not an available option. Learn more on our Holiday Program page.

-

Additional Child Care Subsidy

The Additional Child Care Subsidy (ACCS) is in place to provide additional support with the cost of child care for eligible families. This payment replaces the Special Child Care Benefit (SCCB), Grandparents Child Care Benefits (GCCB), Benefit and Jobs, Education and Training Child Care Fee Assistance (JET).

-

5% Withholding on Payments

Some families are unable to estimate their income accurately ahead of time, so Centrelink withhold 5% of your CCS each fortnight to reduce the likelihood of overpayment.

This means if you overestimated your family income and didn’t receive enough CCS, the outstanding amount will be paid directly to you. This will include the 5% payment withheld over the year.

If you underestimated your annual family income you may have a debt which you’ll need to pay back. The 5% amount withheld will be used to reduce the debt.

- How to Guides